A Stop Order is a provisional order that is executed only when a certain Trigger Price has been hit. Stop Orders are typically used by traders as a risk management technique to limit their losses. The execution of a stop order can be understood as a two-step process:

Step1: Trigger condition is met leading to activation of the stop order. The Trigger Price is also known as the Stop Price.

Step2: A market or limit order is placed immediately after.

Since stop order are activated once a certain condition has been met, they are also known as conditional orders.

Stop Price & Trigger Conditions

Potentially, any of the following three prices can be used to specify the Stop Price for a stop order:

- Mark Price

- Last Traded Price

- Index Price, i.e. price of the underlying

Currently, on Delta Exchange, only Mark Price is used to specify Stop Price levels.

Trigger condition for buy stop orders: These orders are triggered when the price goes above the Stop Price. A trader places a buy stop order to close an existing short position.

Trigger condition: Mark Price > Stop Price

Trigger condition for sell stop orders: These orders are triggered when the price goes below the Stop Price. A trader places a sell stop order to close an existing long position.

Trigger condition: Mark Price < Stop Price

Using Stop Orders to Initiate a New Position

Although stop orders are predominantly used to close existing positions, traders can use them to enter into a new position as well. A good example of this is using stop orders to trade breakouts. A trader can place a buy stop order to go long a contract once it breaches a key resistance level. Similarly, a sell stop order can be used to go short a contract once it breaches a key support level.

Types of Stop Orders

These are the 3 types of stop orders

1.

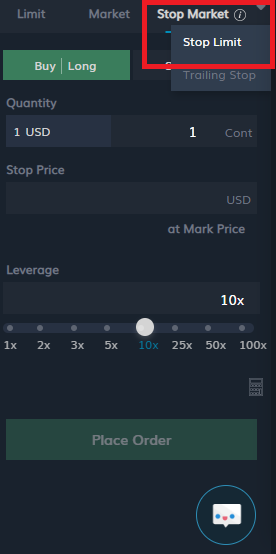

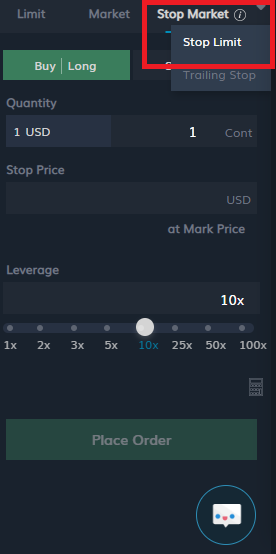

Stop Market Order – For these stop orders, a market order is a placed once the trigger condition has been met. Since market orders are executed immediately, stop market orders help a trader get out of a losing position quickly. On the flip side, the execution price of a market order is not pre-determined. Thus, when the market is moving too quickly, stop market orders may result in slippages.

2.

Stop Limit Order – For these orders, a limit order is placed once the trigger condition has been met. A trader needs to specify the limit price for this order while placing the stop-limit order. Like with any other limit order, here too, execution price is guaranteed but the execution of the limit order may not be immediate.

3.

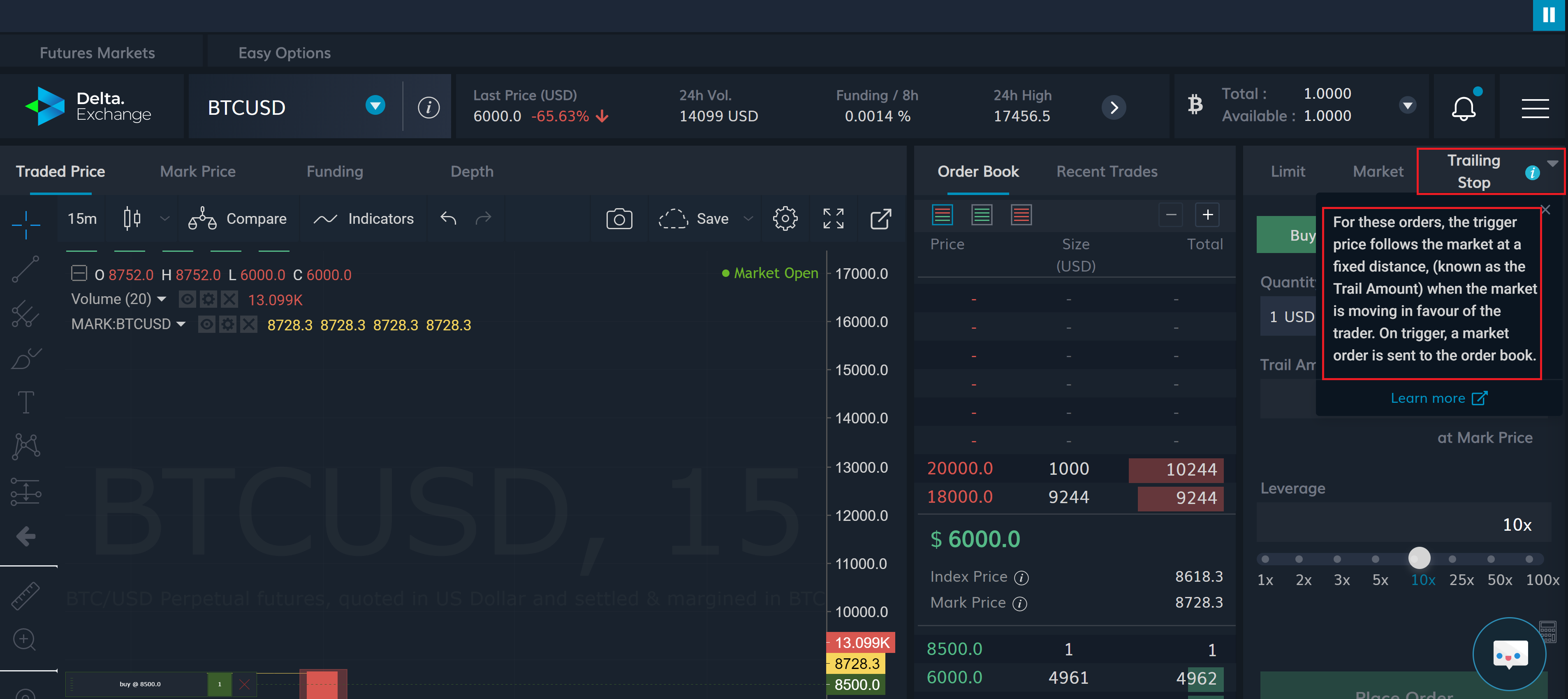

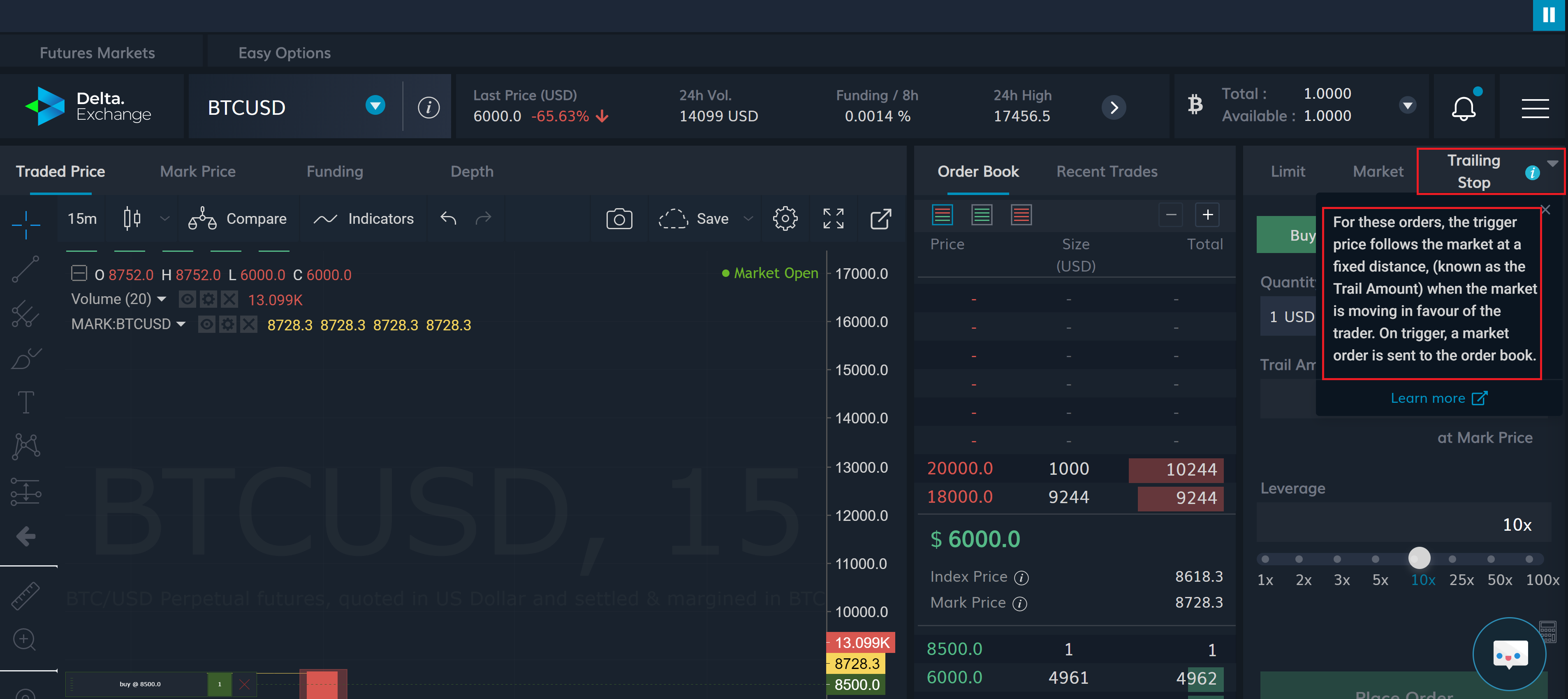

Trailing Stop Order – For these orders, the stop price is not fixed. The stop price of a trailing stop order follows the market at a fixed distance (known as the Trail

Amount) when the market is moving in favour of the trade. And, when the price moves against the trade, the stop price remains unchanged. This behaviour helps to minimize losses while not setting a limit on gains.

When triggered, a trailing stop order results in the placement of a market order. Thus, a trailing stop order is similar to stop market order, but the trigger price is not a pre-specified price, but a value differential.

Buy trailing stop orders: has a positive trail value

Sell trailing stop orders: has a negative trail value

Margining for stop orders

On Delta Exchange, stop orders are margined only when they are triggered. Please read this post for more details.

2. Stop Limit Order – For these orders, a limit order is placed once the trigger condition has been met. A trader needs to specify the limit price for this order while placing the stop-limit order. Like with any other limit order, here too, execution price is guaranteed but the execution of the limit order may not be immediate.

2. Stop Limit Order – For these orders, a limit order is placed once the trigger condition has been met. A trader needs to specify the limit price for this order while placing the stop-limit order. Like with any other limit order, here too, execution price is guaranteed but the execution of the limit order may not be immediate.

3. Trailing Stop Order – For these orders, the stop price is not fixed. The stop price of a trailing stop order follows the market at a fixed distance (known as the Trail Amount) when the market is moving in favour of the trade. And, when the price moves against the trade, the stop price remains unchanged. This behaviour helps to minimize losses while not setting a limit on gains.

3. Trailing Stop Order – For these orders, the stop price is not fixed. The stop price of a trailing stop order follows the market at a fixed distance (known as the Trail Amount) when the market is moving in favour of the trade. And, when the price moves against the trade, the stop price remains unchanged. This behaviour helps to minimize losses while not setting a limit on gains.

When triggered, a trailing stop order results in the placement of a market order. Thus, a trailing stop order is similar to stop market order, but the trigger price is not a pre-specified price, but a value differential.

Buy trailing stop orders: has a positive trail value

Sell trailing stop orders: has a negative trail value

When triggered, a trailing stop order results in the placement of a market order. Thus, a trailing stop order is similar to stop market order, but the trigger price is not a pre-specified price, but a value differential.

Buy trailing stop orders: has a positive trail value

Sell trailing stop orders: has a negative trail value