Before making any deposits, it’s essential to add and whitelist your bank account. This vital step ensures that all future transactions go smoothly and securely.

Log in to your Delta Exchange India account and navigate to the “Bank Details” section.

Enter your bank account number and the corresponding IFSC code, then click on “Add Bank Account.”

For bank verification, Delta Exchange will deposit Rs.1 into your bank account. Once you see the Rs.1 deposit reflected in your account, your bank account is officially verified and ready for further transactions.

Now, to add funds: You can add funds through upi and bank transfer

For quick and convenient

UPI method, follow these steps:

From your account dashboard, click on “Add Funds.”

Enter your whitelisted UPI ID in the designated field.

Initiate the transfer via your UPI app. The transaction will be processed instantly if all details are correct.

Important: Always deposit using your whitelisted UPI ID. Depositing with an incorrect or unverified UPI ID might trigger additional verification steps or delay the processing.

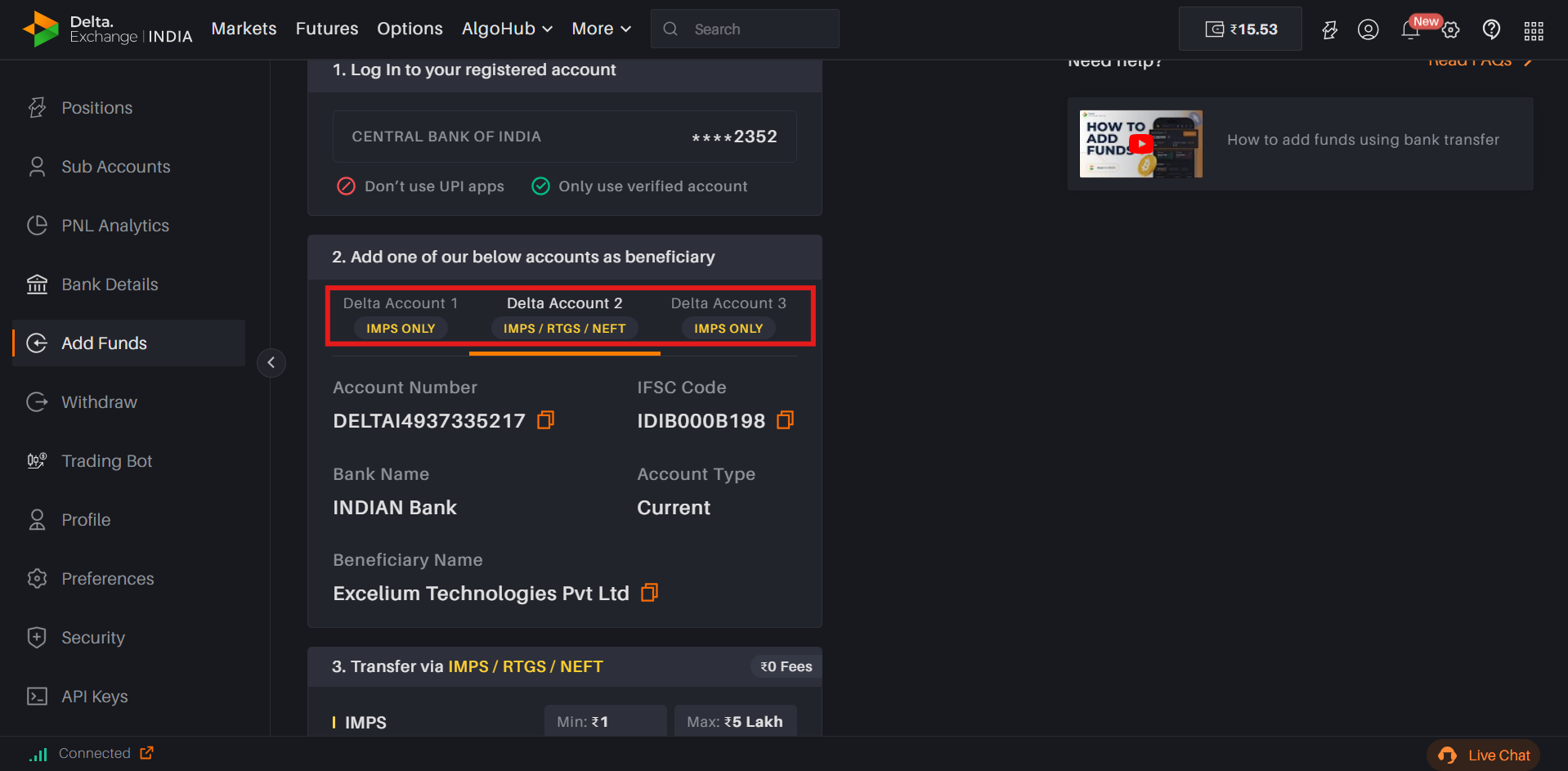

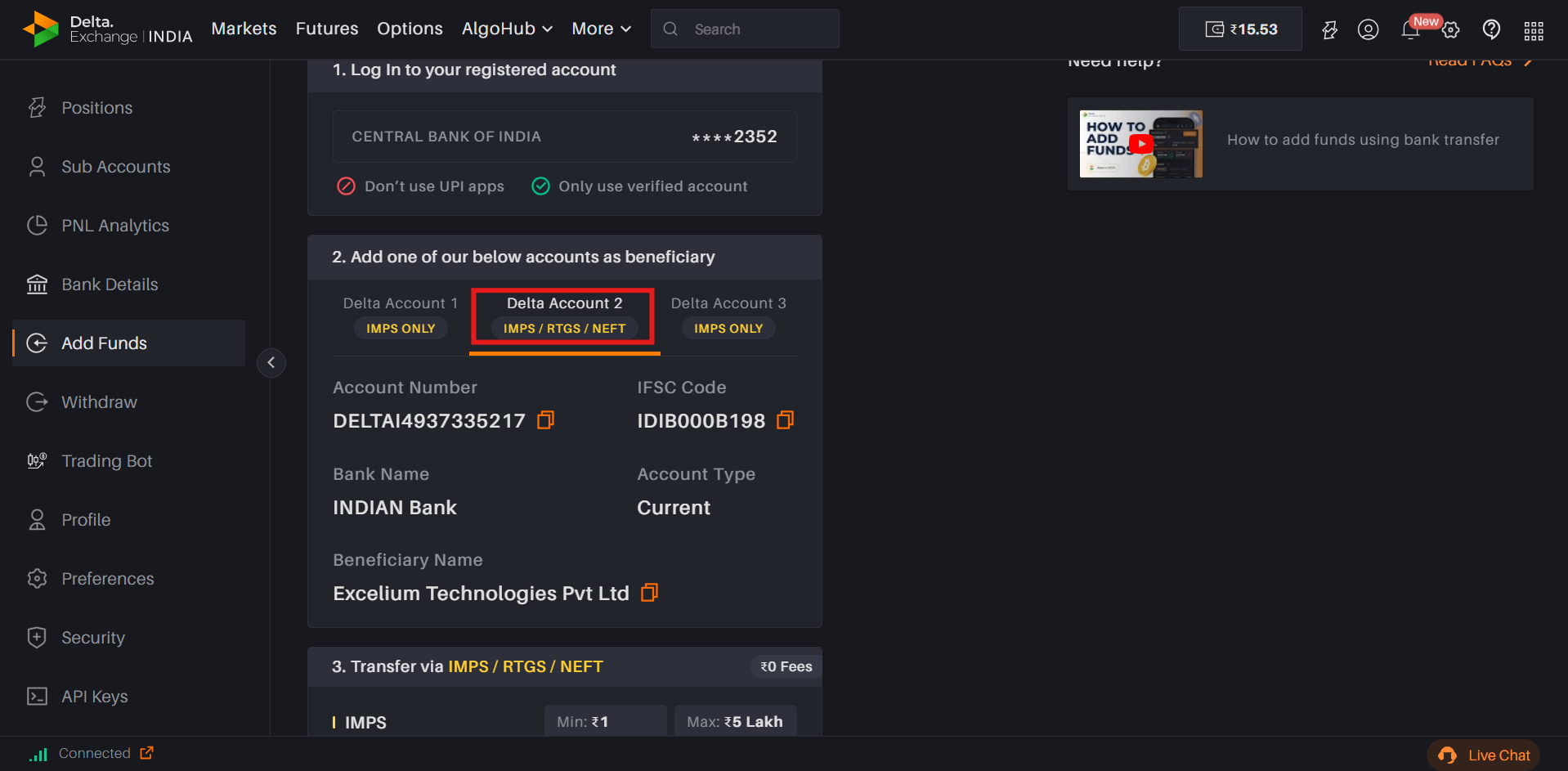

Delta Exchange India also supports deposits via bank transfer. You have three options: IMPS, NEFT, and RTGS. Follow these guidelines carefully to avoid any issues:

Click on “Add Funds” to access the bank transfer options.

Choose between IMPS, NEFT, and RTGS based on your preference:

For IMPS:

- Select the IMPS option for immediate transfers.

- Ensure you’re transferring funds from the IMPS-compatible bank account as listed on the website.

- Verify that the beneficiary details in your banking app match the ones provided on Delta Exchange India.

For NEFT / RTGS:

- If transferring during standard banking hours, select the Delta Account 2 (IMPS/NEFT/RTGS) option as per your transfer amount.

- Ensure that you transfer funds to the designated Delta Account 2 (IMPS/NEFT/RTGS) account shown on the Delta Exchange deposit page.

- Do not mix up transfer methods—depositing NEFT/RTGS funds into an IMPS ONLY account or vice versa may result in delays or failed transactions.

Limits:

- IMPS - Immediate (Max - 5 Lakh)

- NEFT - 1 hour (Max - No Limit)

- RTGS - Immediate (Min - 2 Lakh, Max - No Limit)

Note: NEFT and RTGS transactions done after 10 PM will get transferred at 6 AM next day.

Deposit Processing Time Limits:

UPI: Usually credited within 15 minutes

IMPS: Typically processed within 30 minutes

RTGS: Typically processed within 30 minutes

NEFT: May take up to 30 minutes

Additional Tips for a Smooth Deposit Experience

Double-Check All Details: Whether you’re using UPI or a bank transfer, ensuring that your details exactly match those provided on Delta Exchange India can save you time and hassle.

Troubleshooting Help: If your deposit doesn't reflect within the expected timeframe (especially during banking holidays or outages), contact Delta Exchange India's support team for assistance.