EOS Futures & Perpetual Guide: Trade EOS Futures On Delta Exchange

Understand what EOS futures are and how to use the leverage in futures to amplify your trading gains

EOS Contracts Listed on Delta Exchange

EOS futures enable you to take long (you profit when market goes up) and short positions (you profit when market goes down) on EOS. Futures have in-built leverage which acts as a multiplier to your returns. Currently, the following EOS contracts are listed on Delta Exchange.

EOS Futures Contract Details

| Contract Name | EOSUSD |

|---|---|

| Description | EOS Perpetual |

| Max. Leverage | 20x |

| Margin Currency | USD |

| Taker Fees | 0.05% |

| Maker Fees | 0.02% |

| Contract Type | perpetual futures |

What is EOS Futures Trading?

EOS Futures is an agreement between two parties to buy or sell EOS at a predetermined future date and price. The futures contract derives its value from the underlying cryptocurrency, EOS in this case. Thus the price of a EOS futures contract moves broadly in sync with the price of EOS.

Trading futures is thus an alternative to actually buying or selling the underlying crypto (aka spot trading). In spot trading, you can make profit by buying EOS low and selling it at a high price. This trade however works only in a bull market, i.e. when EOS price is going up. However, in a bear market, there is no trade possible in spot trading. Furthermore, leverage trading is not possible in spot trading.

Trading EOS through futures offers several advantages over spot trading of EOS, namely ability to both long or short and get access to leverage.

Trade profitably in all market conditions

You can profit from rising EOS price by going long EOS futures. And, when EOS price is falling, you can make profits by going short. This feature of futures trading enable you to navigate all types of market conditions profitably. Compare this with directly buying EOS. When price is falling, you can either sell your EOS or suffer losses. In spot trading, there is no way of profiting from falling prices.

Hedge Price Risk

If you are a HODLer, you can still use futures to mitigate price risk. Say, you hold EOS. You can mitigate the risks you face when EOS is falling by going short EOS futures. In this case, a short futures position acts as a downside protection by effectively locking the $ value of your portfolio without the need for selling your EOS. Judicious use of futures as hedge can make you a better and stronger HODLer.

Amplify trading gains with leverage

Leverage enables you to open positions that are bigger than your trading capital. If you can open a position that is 10 times bigger than your trading capital, then you have 10x leverage available to you. The maximum allowed leverage for futures listed on Delta Exchange is as high as 100x. There are two ways of thinking about leverage:

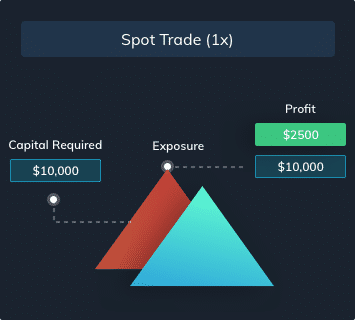

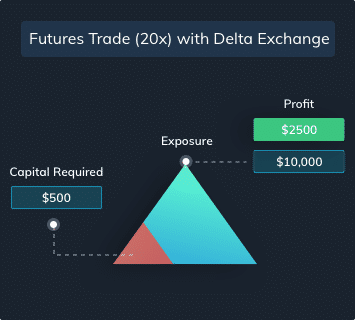

Leverage as capital efficiency driver: For opening a position of a given size, higher the leverage lower the trading capital required. The leverage in spot trading is always 1x, while it is 3-4x in margin trading. This means futures is 20 to 100 times more capital efficient than spot or margin trading.

Leverage as a returns amplifier: Because in a leverage trade position size is greater than the capital deployed, impact of prices moves gets magnified. The return on capital deployed is leverage times the price return. This means that you can amplify your trading gains the effective use of leverage.

If EOS increased from $0 to $0 your return would be equal to:

Benefits of Trading EOS Through Futures

Magnify returns through leverage

In-built leverage magnifies impact of EOS price moves on your return on capital.

Trading both rising & falling markets

Long when bullish. Short when bearish. Trade all market conditions profitably.

Trade more with less

Deploy the capital freed up by using leverage in other trading opportunities

Why Trade EOS Futures on Delta Exchange

Increase profitability

Low trading fees, tight spreads & deep order books of our EOS contracts increase profitability of your trades

Improve risk management

Set TP / SL with your order, Leverage advanced order types and instruments (Options, Interest Rate Swaps) to create hedging strategies

Identify better trades

Use professional charts & advanced analysis tools to quickly identify trading opportunities

Have a Question About Trading EOS Futures?

Why Delta Exchange?

Register Now Competitive spreads & fees

Competitive spreads & fees Generous Rewards

Generous Rewards 24/7 Support

24/7 Support