Bracket order is a powerful and advanced risk management tool that all traders should use. As the name suggests, a bracket order creates a bracket, i.e. a take-profit and stop-loss around a position. A bracket order is comprised of two orders:

- A take-profit order

- A stop-loss order

Both these orders are tightly coupled with a position. And, triggering of either of the take-profit or stop-loss orders results in the position being closed. And, once the position has been closed, there’s no reason for the bracket to exist. Thus, the untriggered order from the bracket is immediately cancelled. The behavior makes bracket orders a type of one-cancels-the-other (OCO) orders.

Traders should understand the following features/ functionalities of bracket orders on Delta Exchange:

- Bracket orders can be set for an existing position as well as while placing an order. When bracket orders are part of an order, they are put into place once the order has been executed and a position has been acquired.

- Bracket orders always close the full position. This means that if the position size changes, its bracket orders are automatically modified.

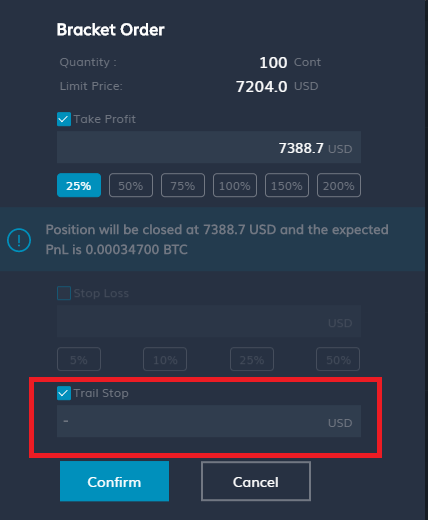

- Traders have the option of specifying one or both of take-profit and stop-loss level as part of a bracket order. Stop-loss can be specified either as a fixed level or a trail value.

- Bracket orders are triggered off mark price. Once triggered, a market order is placed to close the position.

Placing a bracket order

Open Position: A trader can set a bracket order to an already open position from the position tab. Click here to know more on how to place a bracket order from the position tab.

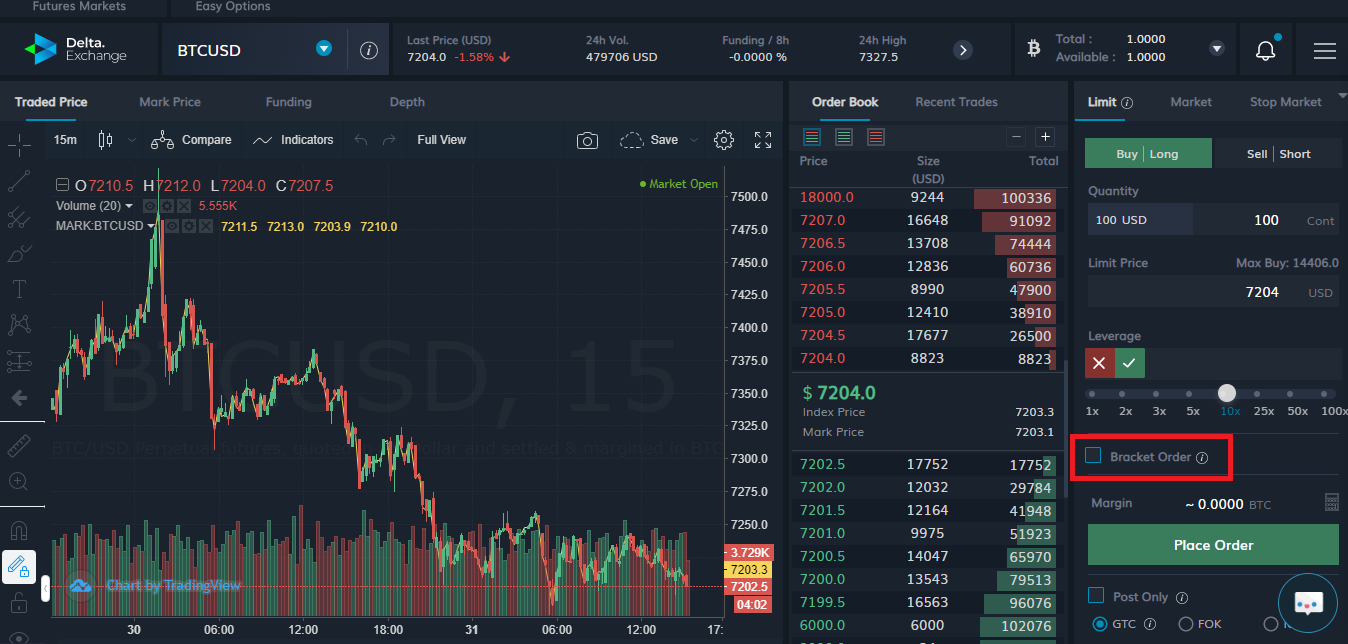

While Placing an Order

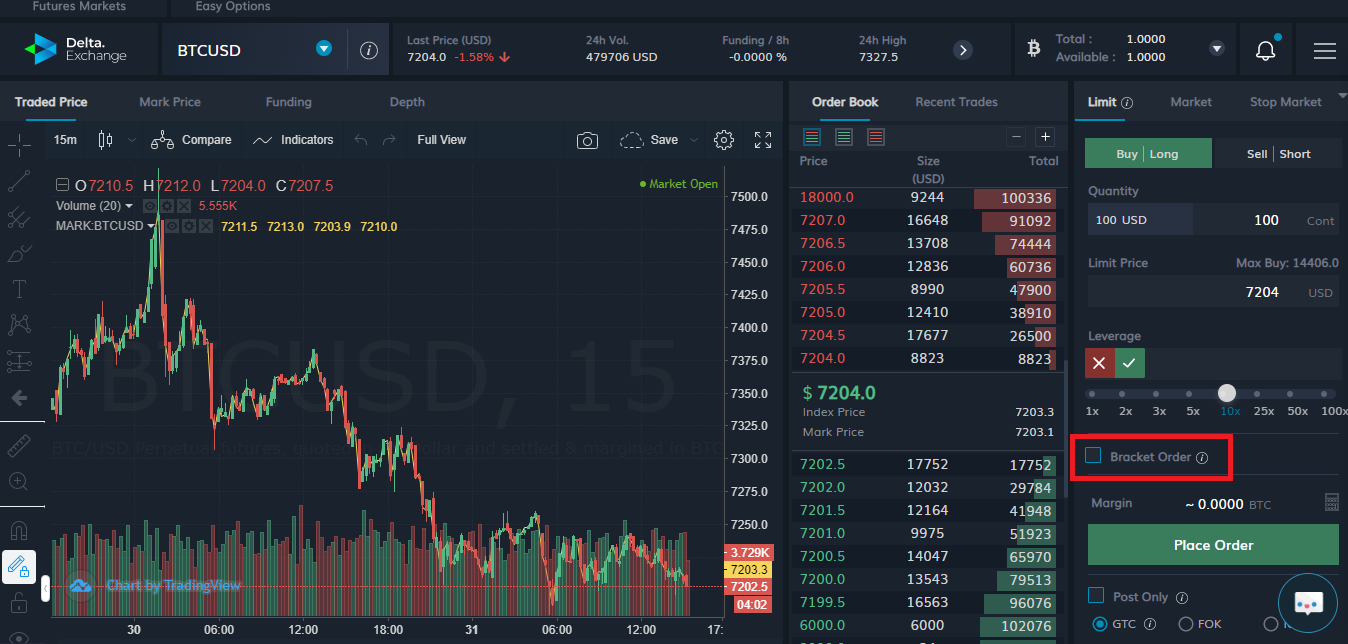

A trader can place a bracket order while placing a limit or market order. The user needs to tick the Bracket Order checkbox and fill in the values in the bracket order boxes. If the trader chooses not to set a bracket order while placing an order, the trader cannot modify the order when it is an open order. In short, modifications for a bracket order is not possible on Delta Exchange right now.

Once the Open Order becomes an Open Position, the trader can then set a Bracket Order. If the trader wishes to place a new order with an already existing position, the trader cannot set a bracket order to the new order. The trader needs to wait for the order to become a position to place a bracket order. The following video showcases how a Bracket Order cannot be placed to an Open Order.

| Can place Bracket Order |

Cannot Place Bracket Order |

| New Order |

Open Order |

| Existing Position |

New Order with an already Open Position |

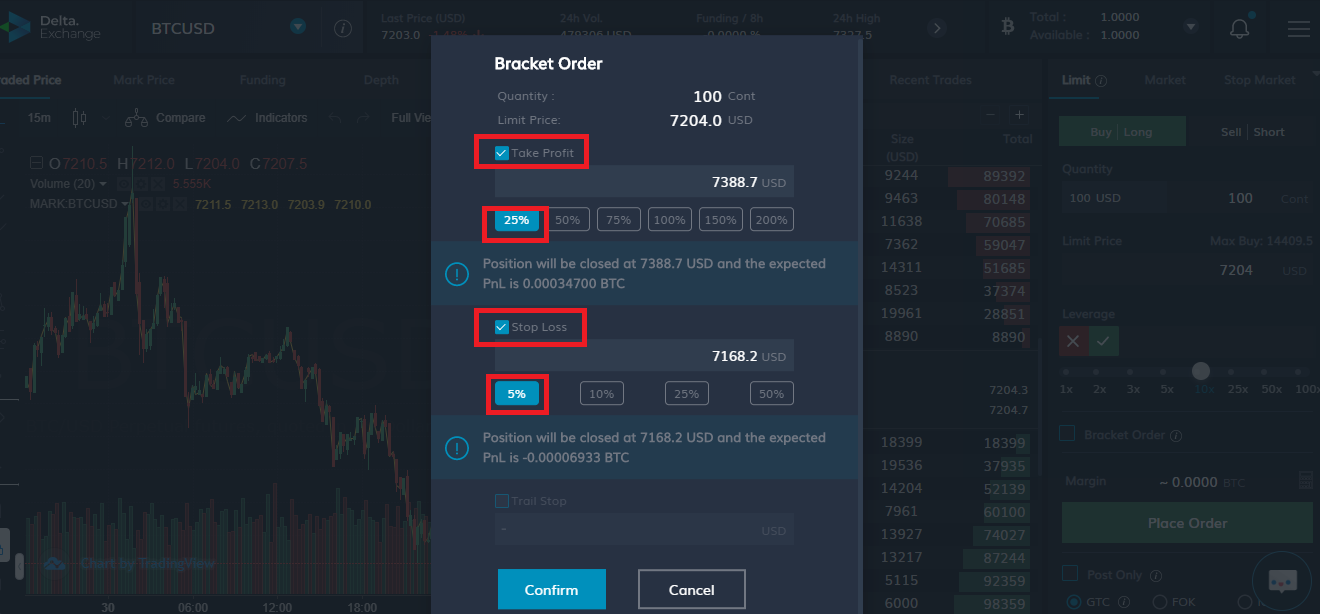

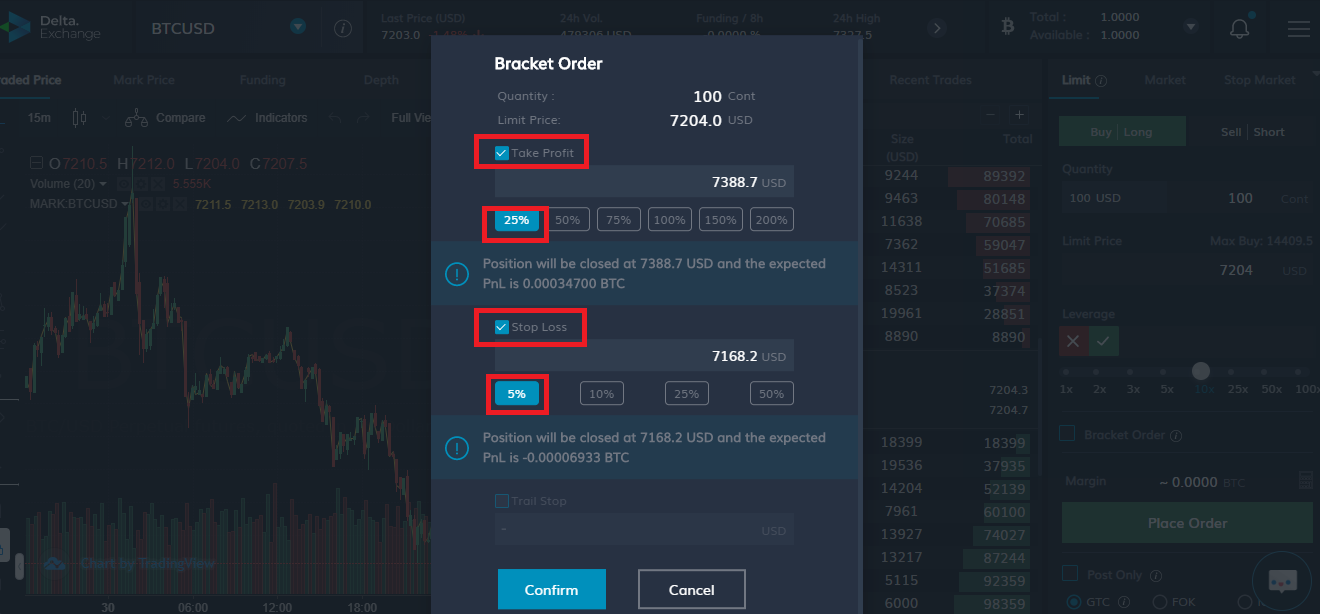

Selecting take-profit and stop-loss levels

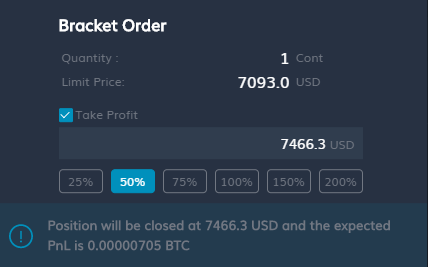

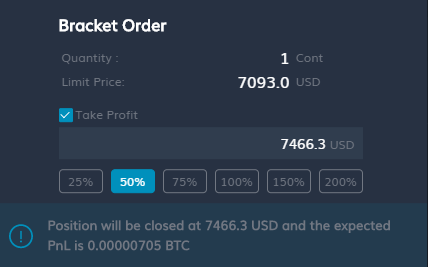

Traders can directly specify take-profit and stop-loss levels. Alternatively, they can choose to close a position on certain RoE levels. This can be done easily by selecting one of the RoE levels presented below take-profit and stop-loss level input boxes.

Let’s understand this with an example. Consider a trader wishes to close his trade one the RoE on the position is 50%. While placing the bracket order, Delta Exchange provides various RoE levels that traders can choose from. This ranges from 25%, all the way till 200%. Once a particular return level has been selected, the system inputs the price at which the trade will close and also mentions the final PnL amount in terms of BTC.

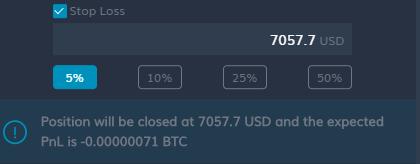

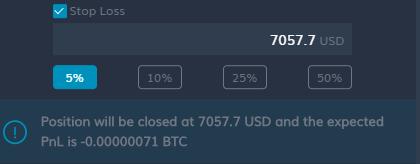

The similar mechanism works for Stop Loss. A trader can mention at what loss % (ROE Terms) do they wish to cut their losses and the system will add in the price on its end. A PnL will be mentioned here too.

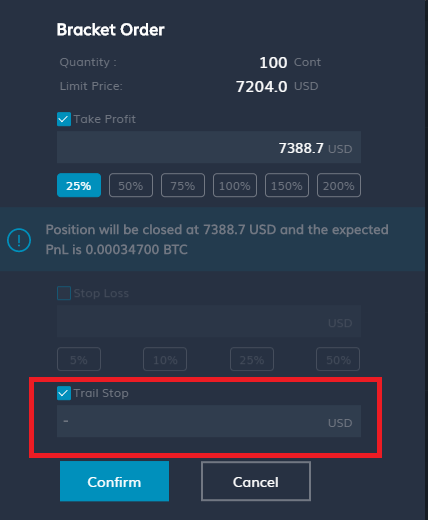

The option of using a trailing stop-loss is also available. A trailing stop loss is used when the trade is moving in your favour. Using a trailing stop-loss is optional and its recommended to use a trailing stop loss to safeguard your gains.

The similar mechanism works for Stop Loss. A trader can mention at what loss % (ROE Terms) do they wish to cut their losses and the system will add in the price on its end. A PnL will be mentioned here too.

The similar mechanism works for Stop Loss. A trader can mention at what loss % (ROE Terms) do they wish to cut their losses and the system will add in the price on its end. A PnL will be mentioned here too.

The option of using a trailing stop-loss is also available. A trailing stop loss is used when the trade is moving in your favour. Using a trailing stop-loss is optional and its recommended to use a trailing stop loss to safeguard your gains.

The option of using a trailing stop-loss is also available. A trailing stop loss is used when the trade is moving in your favour. Using a trailing stop-loss is optional and its recommended to use a trailing stop loss to safeguard your gains.