While trading on a cryptocurrency exchange, traders are exposed to two different types of fees, mainly the Maker and Taker Fess.

Maker Fees

Maker fees are the trading fees for maker orders. Those orders can add to the liquidity on the exchange are known as maker orders. For example, when a trader places a limit order that does not match against an existing order, the limit order enters the order book and waits to be matched. In this case, the limit order augments the liquidity on the exchange and hence is a maker order.

On Delta exchange, the trading fee for Maker orders is 0.03% less than Taker orders for Futures but both the fees are same in the case of options.

Taker Fees

Taker fees are the trading fees charged for taker orders. Those orders that consume/ reduce liquidity on the exchange are known as taker order. For example, market orders are immediately executed against existing orders in the order book. Due to this, market orders are always taker orders. Even limit orders that are immediately executed are taker orders.

The trading fee for taker orders, i.e. taker fee is positive on Delta Exchange. This means that a trader needs to pay a fee on the execution of a taker order.

The maker and taker fees can vary from contract to contract. Fees for all the contracts listed on Delta Exchange is available

here.

How to receive maker fees

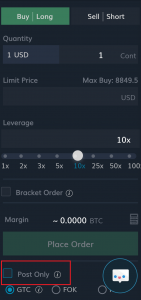

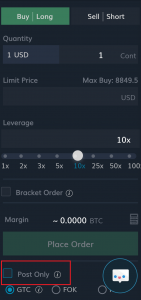

To ensure that your order becomes a maker order, place your limit orders with a post only flag enabled. Post only order never execute immediately and thus, always add to the liquidity in the order book. In case, a limit order with post only flag will match against a pre-existing order in the order book, the limit order will be cancelled. You can read more about post only orders here.